Things to know before buying first house in Nova Scotia

Buying your first home is an exciting milestone and a happy dream for most of us. However, it’s also a complex process that requires careful planning and consideration, especially in a unique market like Nova Scotia.

This guide provides an in-depth look at the key factors you should consider to make your home-buying journey as smooth and successful as possible, especially for first time house buyers.

Of course using services of a best licensed real estate agent is a huge factor in helping you get that dream house, nonetheless, you should know about a few things before you get onto a property deal that you might regret later.

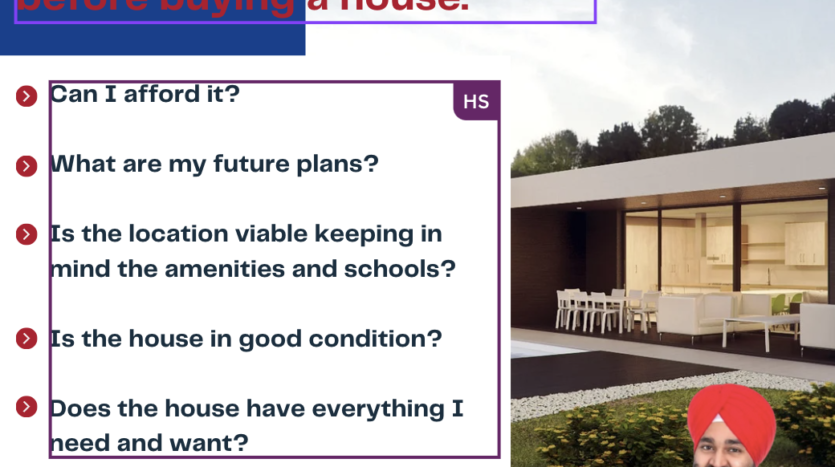

8 Things to consider before buying first house in Nova Scotia

Below you will see a detailed overview of the essential steps and considerations for first-time homebuyers in Nova Scotia, ensuring you’re well-prepared for this significant investment. Click here if you want to check our Halifax house buying guide

Understanding Your Finances

The first step in your home-buying journey is understanding your financial status. Start by First thing first, start by saving for a down payment and knowing your credit score/ report.

The minimum credit score required to get a mortgage in Nova Scotia is 640. But, if you want to get the best interest rates, you better take care of your credit score. If your credit score is low, you can get a mortgage from a B- Lender at a higher interest rate and larger down payment.

Your down payment is the sum of money you should deposit and ranges from 5% to 15% of total home purchase price.

Nova Scotia offers many incentives for first time home buyers. So, check them out here. These programs provide people with additional loans or rebates or interest free loans to a certain extent.

After that, focus on getting pre-approved for a mortgage to determine how much you can afford. Also, it’s crucial to factor in additional costs such as closing fees, property taxes, home insurance, and potential renovations. Creating a budget for these expenses will help you navigate your financial boundaries effectively.

At the gist, before buying first house in Nova Scotia, make sure you have a good financial foundation.

Choosing the Right Location

Nova Scotia offers a variety of locations, each with its unique advantages. Whether you’re looking for the bustling life of Halifax, the serene beauty of the Annapolis Valley, or the rugged shores of Cape Breton, consider what matters most to you.

Proximity to work, schools, amenities, and the overall community vibe should play a significant role in your decision-making process. Other than that, you should also keep in mind factors like cost of living, size of neighborhood and the potential of the growth of the location.

Market Research and Finding a good real Estate Agent

Understanding the local real estate market trends is vital, before buying a house in Nova Scotia. The market in Nova Scotia can vary significantly from one area to another. Research recent sales in your preferred areas to get a sense of the market conditions. This information can help you make an informed decision about when to buy and how much to offer.

Market research is a vague and time consuming process. Getting help from Realtors can help you navigate the buying process.Contact Pavneet Singh here for up to date news on Real Estate and getting best deals for yourself.

The Importance of Home Inspection

You should never skip the home inspection before buying a house in Nova Scotia. This step is crucial in identifying potential issues with the structure, plumbing, electrical systems, and more. Hiring a professional inspector can save you from future expenses and provide peace of mind.

A lot of time, home buyers tweak a thing or two in the house they purchase, but it will be more viable for you if the house is in otherwise good condition, so that your money is not leaking everywhere and you can make the few changes you want for your dream home.

Legal and Regulatory Considerations

Engaging a real estate lawyer early in the process is advisable. They can help navigate the complexities of real estate transactions in Nova Scotia, ensuring that the property has no legal entanglements that could complicate your purchase.

This also helps you make sure that all the steps in home buying are in accordance with good trade practices and governing legislation.

This also helps you make sure that all the steps in home buying are in accordance with good trade practices and governing legislation.

Long-Term Planning and Sustainability

Before buying first house in Nova Scotia, you should first think about your long-term goals. How long do you plan to live in this home? Are you planning to start a family, or will you need a home office? Your current and anticipated needs should influence the type of property you buy.

You should also consider the energy efficiency of potential homes. Nova Scotia’s climate can lead to high heating costs in winter, so well-insulated homes with energy-efficient systems can save you money in the long run. Moreover, the provincial government offers various programs to help homeowners invest in energy-saving upgrades.

Negotiating Your Purchase

Once you’ve found a home you love, it’s time to make an offer. First, know what you want to know about the house, like the age of the house, number of bedrooms and bathrooms, type of neighborhood, and price range of the house.

Does the house come with a garage? Does it require big renovation any time soon? Is the price on market value?

This is where your market research comes in handy. Know the worth of the home and start your negotiations from an informed point. Remember, the asking price is not always set in stone.

Tips to know before buying first house in Nova Scotia

Tips to know before buying first house in Nova Scotia

Closing the Deal:

When your agent takes you to multiple house showings, compare all the factors that matter to you and choose the trade off that works the best for you. After your offer is accepted, there are several steps to close the deal.

This includes finalizing your mortgage, conducting a title search, purchasing home insurance, and setting up utilities. Your real estate agent and lawyer will guide you through these final steps.

Things to know before buying first house in Nova Scotia : Conclusion

Buying your first house in Nova Scotia is a challenging but a rewarding experience. It requires meticulous planning and consideration from years ahead.

By understanding your finances, choosing the right location, conducting thorough inspections, and navigating the legal landscape, you can make well-informed decisions that lead to a successful purchase.

Don’t hesitate to get the best Real Estate Agent who will provide you guidance through all the steps. Remember, this is not just about finding a house, but creating a home for your future.

Pingback: Is it worth buying a house in Halifax in 2024?